Tuesday, November 3rd, 2020 marks the 59th presidential election. Voters have the option to reelect current Republican, President Donald Trump, or elect Democratic nominee, Joe Biden and his vice-presidential running mate, Kamala Harris. During these times, investors may worry whether an election will cause volatility in financial markets, and potentially affect their investment returns. Much of this anxiety is unnecessary as the stock market frequently performs independently to whomever wins the ballot every fourth November.

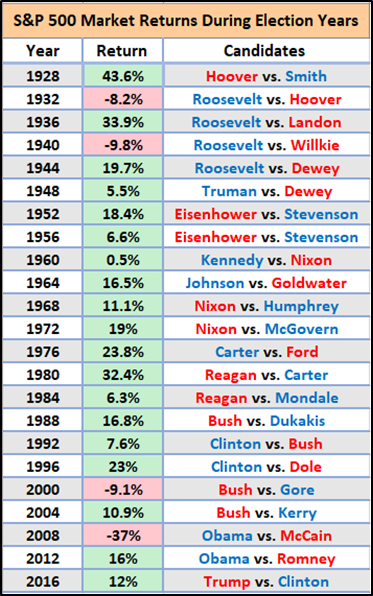

Since 1928, the S&P 500 was negative four times out of the past twenty-three presidential elections. These down years can be explained through economic factors such as the Great Depression of 1932, the hardships during the second year of WWII in 1940, the Dot-com bubble in 2000, and the stock market crash of 2008. Despite these negative historical occurrences, the average yearly return of the S&P 500 during an election year has been 11.28%.

Figure 1: Market results for the S&P 500 for every election year since 1928.

Data above is from Dimensional’s “Matrix Book 2019”.

Rather than try to forecast what may or may not happen as November approaches, think of ways you can improve your investment outlook. Be sure to make changes for the right reasons; results of an election may not be a good reason to make changes in your investment portfolio, but other factors can certainly lead you to take steps in this direction. Follow a long-term strategy based on your goals, risk tolerance, and be sure to have the patience and perseverance to keep investing in the markets throughout the ups and downs.

As an investor, it is wise to be aware of what is happening every four years during an election, but do not allow for these events to dictate your financial decisions, either. In the long run, try to “cast your ballot” for the options that can enable you to make progress towards your important goals.

Client Login